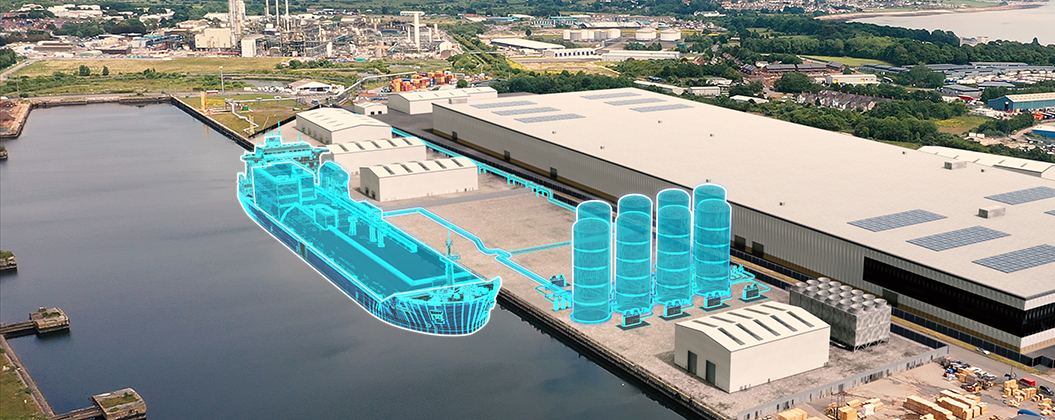

CGI impression of CCS transport and storage infrastructure in a port.

- Marking the international North Sea Summit being held in Hamburg focused on greater cross-border cooperation on expanding energy transition initiatives across the North Sea, a number of key UK and European port and infrastructure players have announced agreements to advance carbon shipping in the North Sea.

- Associated British Ports (ABP), LBC Tank Terminals (LBC), North Sea Port and the Port of Esbjerg have signed two significant Memoranda of Understanding to study the potential of Carbon Capture and Storage (CCS) shipping corridors between Northern Europe and the UK, as well as sharing experience and understanding of this new but crucial energy transition area.

- Shipping captured CO2 is a vital step towards decarbonising energy generation and heavy industry, safeguarding and creating thousands of good jobs and creates a market for a new energy commodity, opening the way for lower costs.

- The UK has world leading geological capacity for storing captured carbon and ABP has already achieved planning approval for a CCS handling terminal at the Port of Immingham, linked to the Viking CCS cluster.

- LBC’s operational expertise and strategic infrastructure make it ideally positioned for the seamless supply chain for captured CO₂, including temporary storage, processing, and shipment.

- North Sea Port comprises a wide variety of industries, all looking into different decarbonisation routes, amongst others CCS. Therefore North Sea Port is actively supporting CCS projects through its central location, infrastructure and logistics capabilities and has ambitions to play a bigger role. The port area in Vlissingen is a strategic location to both receive captured CO2 from diverse off-grid locations and transship it onto ships for transport and storage offshore.

- The Port of Esbjerg is central to the Greensand CCS project, which aims to establish the EU’s first full CCS value chain. Construction began in May 2025 on a CO₂ transit terminal at Esbjerg, featuring six large tanks (each ~1,000 tonnes capacity) for liquefied CO₂. This terminal will serve as a logistics hub for captured CO₂ from Danish biogas plants, which will be shipped to the Danish North Sea for permanent storage.

A Bold Vision for the Energy Transition

The Memoranda of Understanding (MoU) – one between ABP and LBC and North Sea Port and one between ABP and the Port of Esbjerg – set the stage for collaborative efforts to develop shipping routes for captured carbon dioxide (CO₂), enabling hard-to-abate sectors to cut emissions while supporting and growing good jobs. This new shipping market adds to the positioning of ports as key players in the green economy.

Henrik Pedersen, Chief Executive Officer of ABP, said:

“Ports have always been gateways for energy. Today, they are at the forefront of the energy transition. This agreement is about building the infrastructure and partnerships needed to decarbonise industry and create new opportunities for sustainable growth. It paves the way for the UK to utilise its world leading geological assets to provide near term options for emissions reductions across Europe and realise significant export potential for the UK.

This is not just about reducing emissions – it’s about creating a new market for carbon shipping that will help Europe meet its climate goals and secure industrial competitiveness and the jobs that rely on it at pace.”

Turning captured carbon into a new growth market for ports

The two MoUs will focus on:

- Designing port infrastructure for CO₂ handling, storage and shipping.

- Building a robust value chain for CO₂ transport between ABP’s Humber ports and leading European ports and infrastructure asset owners.

- Driving innovation and efficiencies in carbon capture, utilisation, and storage (CCUS) related transportation.

Voices from MoU Partners

Cas König, CEO, North Sea Port said:

“Our sustainability ambition is clear: a net zero port by 2050. To this end, we are creating connecting infrastructure with our partners. CO2 transport by ship is an additional and flexible means in the chain of industrial decarbonisation. By signing this MoU with ABP and LBC, we are taking a practical step to investigate a cross‑border CO₂ corridor that connects emitters to certified storage in the North Sea. Leveraging our shared port infrastructure and maritime expertise, we aim to cut costs, accelerate deployment, and ensure the energy transition strengthens – not weakens – Europe’s industrial competitiveness.”

Radboud Gordon, Group Business Development Director New Energies, LBC Tank Terminals, said:

“Signing this MoU is about moving from vision to tangible progress. By combining LBC’s operational expertise in safe and sustainable storage with the port capabilities of ABP and North Sea Port, we can design an efficient, scalable shipping corridor that connects European emitters to UK storage at pace, supporting a competitive, cross‑border CO₂ market.”

Dennis Jul Pedersen, CEO of Port of Esbjerg, said:

“Europe is at the beginning of a new reality where CCS will play an increasingly important role in supporting investment and jobs in critical industrial and energy sectors. Collaboration is key to unlocking the potential of carbon shipping. By partnering with ABP, Esbjerg aims to create scalable solutions that support Europe’s decarbonisation ambitions and strengthen the role of ports in the green transition.”

A North Sea Collaboration with Global Impact

The North Sea’s geological capacity for permanent carbon storage makes it a natural hub for this emerging market. By connecting emitters of CO2 with storage operators, via shipping routes, ABP and their partners aim to deliver scalable solutions that accelerate the energy transition.

Providing storage services to EU countries increases the utilisation of UK CO2 storage infrastructure, supporting jobs, ongoing private sector investment as well as generating UK tax receipts.

This MOU follows a Carbon Capture and Storage Association (CCSA) report concluding that a pan-European CO2 market - inclusive of the UK - is a key driver for cost-efficiency, potentially lowering storage costs by 20% through economies of scale and proximate storage locations.

Olivia Powis, CEO, CCSA, said:

"We fully support the MOUs between our Member ABP and key players in Europe. This represents a significant step in strengthening cross-border cooperation among European ports, enabling all partners involved to benefit from a ~20% cost saving on CO2 transport & storage, as a direct result of deepened EU-UK ties". She added, "The signing of these MOUs could not be more timely, taking place just ahead of the International North Sea Summit in Hamburg and its focus on expanding cross-border cooperation in Europe."

Building on the strength of the Viking CCS cluster

The Viking CCS project, a leading UK-based CO2 transportation and storage network, represents the most mature project in ABP's current portfolio of CCS solutions. The project involves receiving captured CO2 via ABP’s Immingham Green Energy Terminal (IGET) for secure and permanent storage in depleted gas reservoirs in the Southern North Sea. IGET recently achieved full planning permission, via a Development Consent Order.

This initiative is central to establishing a world-leading CCS industry in the Humber region, the UK's most industrialised area and largest emitter of CO2. By repurposing existing pipeline infrastructure and developing new import terminals like IGET the project provides a competitive, low-cost solution for industrial decarbonisation, both within the UK and internationally, via shipped CO2.

Even for the initial anchor phase of Viking CCS the project will already make a substantial economic and jobs contribution, i.e.:

- £3.7billion of private sector investment between 2027-2030 (with potentially £13 billion of investment over the full project)

- £7 billion of Gross Value Added to the UK economy

- ~8,000 jobs supported at peak construction (rising to ~18,000 jobs for build out phase)